HOW TO MAKE THE MOST OF YOUR AFTER-TAX 401(K)

You are likely already aware that an employee may make pre-tax 401(k) contributions of up to $22,500 (or $30,000 if over age 50) per year. However, as of 2023, the maximum amount one can save in a retirement plan, including employer contributions, is $66,000 (or $73,500 if over age 50). This creates a huge opportunity for many people to maximize the rest of their potential 401(k) savings through after-tax 401k contributions. Quite honestly, most high-income executives fail to take advantage of this great account funding opportunity.

Many 401(k) plans offer the option of after-tax contributions once the employee has met the annual pre-tax contribution limit. The benefit of after-tax contributions to your employer retirement account is the chance to save even more funds for financial independence. These assets grow tax-deferred and then one can potentially convert those contributions to a Roth account while working, setting yourself up for tax-free withdrawals in the future. About half of all 401(k) retirement plans offer after-tax contributions, so check with your plan administrator to find out if this option is available to you. It will clearly be written in the “Contributions” section of your 401k’s Summary Plan Description (SPD).

This strategy works well for high income earners who have already maxed out other savings options, or for employees over 50 who are looking for ways to super-fund their retirement accounts and create a bucket of tax-free money for the future. This is an awesome benefit and one of my personal favorite planning techniques.

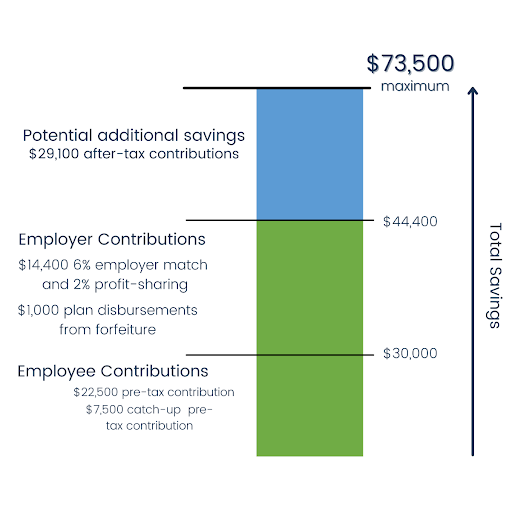

Here is an example of how to take advantage of this Mega Roth opportunity:

Jane Doe is an employee at a biotech company earning $180,000. She maxes out her 401(k) contributions and her over age 50 catch-up contributions. In this example, her employer contributes a 6% match and 2% profit sharing, plus another $1,000 in plan disbursements from forfeitures. Her mega Roth opportunity looks like this:

By taking advantage of after-tax contributions in her 401(k), Jane can contribute an additional $29,100 annually towards her future financial independence.

The tax benefits continue with in-plan conversions

After you have made your after-tax contributions, you can go a step further and do an in-plan conversion of those contributions to a Roth account if your employer offers this option. When you convert after-tax balances to a Roth, no taxes are due on the conversion of your contributions. Any associated earnings on those contributions can be rolled over to a traditional IRA, which will not incur any current income tax.

If your employer does not offer a Roth account option, it is often possible to roll your after-tax contributions to a Roth IRA of your own. This option may present more considerations on your behalf, but the tax savings could make it well worth your while.

Comparison: Maximizing only pre-tax contributions versus maximizing the Mega Roth

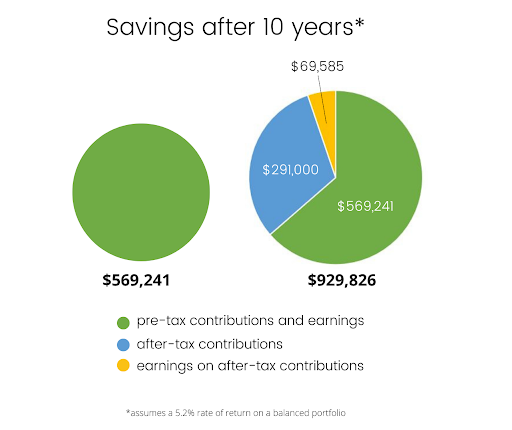

If Jane contributes the maximum in pre-tax contributions for the next ten years at a modest 5.2% rate of return, she will have a balance of $569,241. This is great! However, if she decides to take advantage of the Mega Roth opportunity, contributing the full $73,500 and annually converting her after-tax contributions to a Roth for the next ten years at the same rate of return, she will have an ending balance of $929,826! The difference in her savings looks like this:

An additional benefit to her after-tax contributions is that they continue to grow tax free once rolled over to her Roth IRA, providing tax-free income in the future, and building in some much-needed tax diversification. With the upper income brackets being relatively low based on history, my guess is that taxes will increase long-term. Eventually, the mounting US federal debt, Social Security shortfalls, pandemic economic stimulus programs, etc. will need to be paid for with increased tax revenues. Did you know that the top US Marginal Tax Rate was 70%+ throughout the 1970s?1 Ouch. If tax rates do escalate long-term, then the value of tax-free assets is further multiplied.

This article is intended to present you with an overall strategy for maximizing your workplace retirement plan. There are many factors to consider when deciding whether this strategy is advantageous for you, especially surrounding the details of your own employer’s plan. As with any financial strategy, please do your own due diligence and talk with your advisor or CPA to determine whether this is best for you.

1 taxpolicycenter.org/statistics/historical-highest-marginal-income-tax-rates

Do you have a question about Mega Roth IRAs that is not answered here?