Does triple tax free sound good to you? I hope so. HSAs (Health Savings Accounts) are one of the few investments out there that can qualify as such. Here is how they work:

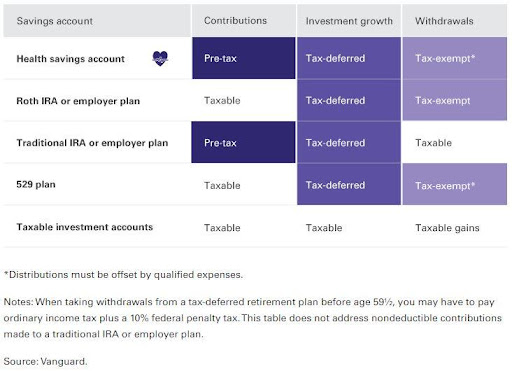

An HSA is a tax-advantaged savings account used to save for medical expenses for taxpayers enrolled in a high-deductible health insurance plan. A health plan is considered “high deductible” if it has a minimum deductible of $1,500 (Individual) or $3,000 (family) in 2023. Contributions to an HSA are 100% tax deductible, interest earnings accumulate tax-deferred, and withdrawals are tax-free if used for qualified medical expenses. That is a potential triple tax savings opportunity! Here is how an HSA compares to other investment accounts:

Which type of savings account is right for you?

Taxes now, taxes later, or with an HSA, maybe never1

Sometimes Health Savings Accounts are confused with Flexible Spending Accounts (FSAs). However, unlike FSA contributions which generally must be spent by the end of the plan year, HSA funds are not “use-it-or-lose-it” and balances may be rolled over from one year into the next. The annual HSA contribution limit is $3,850 for individuals and $7,750 for families for tax year 2023.

Should I enroll in a high deductible health plan to take advantage of an HSA?

Typically, by enrolling in a high deductible health plan, the employee assumes the potential for higher out-of-pocket medical costs in exchange for lower premiums. This can sometimes be a “win-win” for both employer and employee. The employer incurs lower premium costs while the employee is eligible to contribute to an HSA. For this reason, individuals and families who are healthy and typically have lower than average medical costs should investigate HSAs.

For those who experience higher than normal medical costs on a year-to-year basis, or even in one particular year (planned surgery, for example) it might be more beneficial to choose a lower deductible plan and let the insurer assume the brunt of the medical expense risk. Medical expenses are not always transparent and predictable, so it might not be easy to predict whether to choose an HSA compatible plan or not. You will have to research to determine which plan is right for you.

HSA as an Asset: The long-term value of investing in an HSA

Two things that many people may not realize is that: 1) you do not have to withdraw the funds to pay for medical expenses in the year that the expenses were incurred and 2) you can treat an HSA as a long-term investment account.

Consider the example of Tom Brady who has shoulder and wrist surgeries at the age of 50 at a total out-of-pocket cost of $10,000. That same year, Tom pays for his surgeries out of pocket rather than paying for the surgery with HSA funds. He then invests $7,750 into his HSA, experiencing an immediate tax-deduction. Lots of HSAs offer people the opportunity to invest their funds, rather than keeping them in cash, so Tom allocates the funds to an equity investment. Twenty-five years later, Tom decides that he wants some more tax-free income in retirement. (His football pension must have been underfunded.) Tom can take $10,000 out of his HSA for the medical expense incurred at age 50 and use it for whatever he chooses. No taxes will be due for his withdrawal. Assuming his original $7,750 HSA contribution grew at an average 6%/year, his investment would have grown to $33,261, leaving $23,261 more for other medical-related expenses moving forward. He can use the remaining funds to pay for any other qualified expenses from the past (or future) 25 years for which he has not made an HSA withdrawal, such as periodontics, eyeglasses, prescription medicine, and nursing home care, among others. It is important to save and scan your receipts!

HSAs are a powerful tax-saving and financial planning tool. Small changes create big long-term opportunities. Being potentially triple tax-free is a strong foundation. This article goes over some of the basics. Everyone’s situation is different, so please do your own due diligence and talk with your planner or CPA on the advantages of these plans and how you might benefit.

1Source: Vanguard’s “HSA: Health account with a powerful wealth-building benefit”

Do you have a question about HSAs that is not answered here?